Study Guide Foundations For Personal Finance

Personal Finance Foundations - Chapter Summary. This chapter will provide you with a review you can use to improve your understanding of the different aspects and components of personal finance.

- Foundations in Personal Finance for Homeschool is a turn-key high school, personal. Teacher guide on CD-Rom with more than 35 activities, case studies, and.

- Take our comprehensive test prep course to study for the DSST Foundations of. DSST Personal Finance: Study Guide. DSST Foundations of Education: Study Guide.

Equipping and Inspiring Teens for Life Homeschooling is a big commitment, but you're making a great investment in the lives of your kids. And when it comes to teaching them personal finance principles, we're here to help.

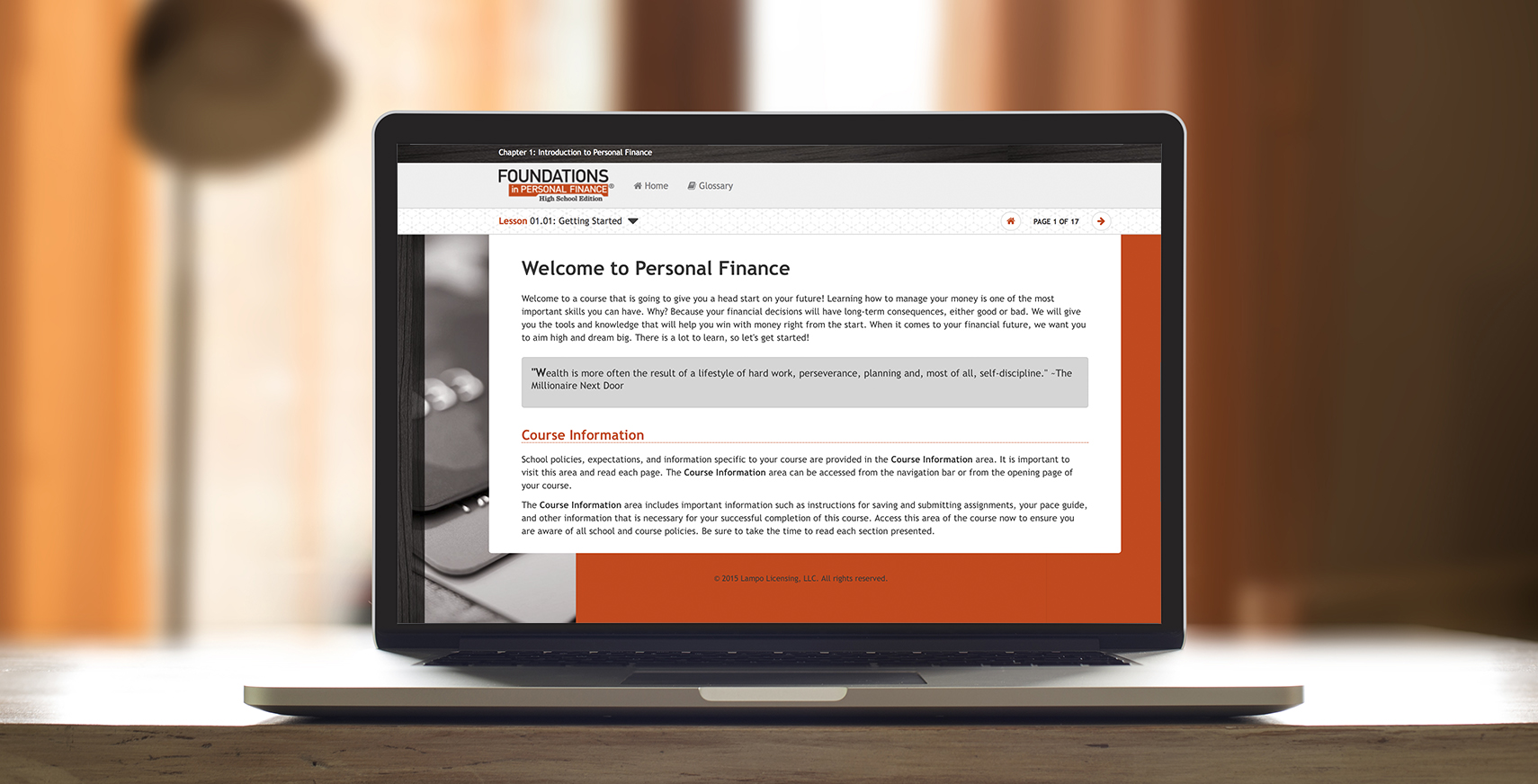

Foundations in Personal Finance: High School Edition for Homeschool is designed as a complete curriculum, saving you time and equipping you with everything you need for a dynamic learning experience. The curriculum includes a student text, teacher resources, and lessons delivered via video by our Foundations team. Our team serves as the financial experts so you don't have to be, giving you back time to focus on your student(s). In addition, more than thirty-five activities are included in the curriculum, which focus on providing personal finance knowledge and life skills in a student-centered, competency-based approach to learning. The activities also utilize our blended learning website,.

Personal Finance Study Guide Quizlet

The Foundations series currently includes editions for both high school and middle school grade levels. The high school edition can be used either as a stand-alone curriculum or as a deeper dive into financial literacy from the Foundations in Personal Finance: Middle School Edition for Homeschool. Chapter 1: Introduction to Personal Finance Introduces the topic of personal finance, explores the evolution of the American credit industry, and highlights the importance of both knowledge and behavior when it comes to managing money.

Chapter 2: Saving Emphasizes the importance of saving and explains the three reasons to save: emergencies, large purchases, and wealth building. Chapter 3: Budgeting Explores the purpose and process of writing a budget and the basics of banking, including balancing and reconciling a checking account. Chapter 4: Debt Identifies the devastating costs of using debt as a financial tool, debunks credit myths, explains the elements of a credit score, identifies organizations that maintain consumer credit records, and summarizes major consumer credit laws. Interview questions for a manager.

Chapter 5: Life After High School Explores 21st Century post-secondary education and career options, highlights the importance of avoiding debt as a young adult, and explains how to cash flow a college education. Chapter 6: Consumer Awareness Identifies factors that influence consumer behavior and the effect of inflation on buying power. Chapter 7: Bargain Shopping Highlights the importance of bargain shopping as part of a healthy financial plan and identifies important negotiation strategies. Chapter 8: Investing & Retirement Establishes basic investing guidelines, describes and compares various types of investments, and identifies elements of employer benefits and retirement plans. Chapter 9: Insurance Identifies the purpose of financial risk management as well as the appropriate and most cost-effective risk management strategies. Chapter 10: Money & Relationships Identifies the differences among people's values and attitudes as they relate to money and highlights communication strategies for discussing financial issues. Chapter 11: Careers & Taxes Examines the importance of pursuing a career in line with your strengths, the elements of effective goal setting, the best practices of successful people, and types of income and taxes.

Dsst Personal Finance Study Guide

Chapter 12: Giving Highlights the importance of giving of your time, talents, and money in order to serve others and leave a lasting legacy.